Enquiry Call : +91 9987-168-169 +91 9821-994-994

Trade Like A Professional

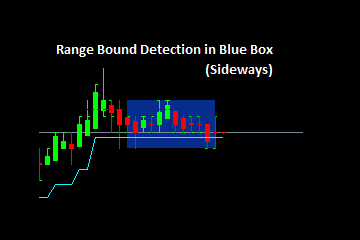

Range bound Detection

(Sideways & Wide Range Detection)

This UNIQUE function Detects Range bound(Sideways) & Wide Range. A range-bound market is one in which price bounces in between a specific high price and low price. The high price acts as a major resistance level in which

price can’t seem to break through. Likewise, the low price acts as major support level in which price can’t seem to break as well. Market movement could

be classified as horizontal or sideways.

This system is to avoid false trade which occurs during sideway (Rangebound), when ever Blue box appear then, it means range bound detected. During this time we should not take any fresh position and when range bound blue box disappear we can take continues position which ever signal is presently active buy or sell, or wait for fresh buy or sell signal.

This Feature also Prevents Trader from Wipsaw Trade (False Trade) and also Alerts for Upside or Downside RangeBound Broken and gives Entry when its

comes in Wide Range.

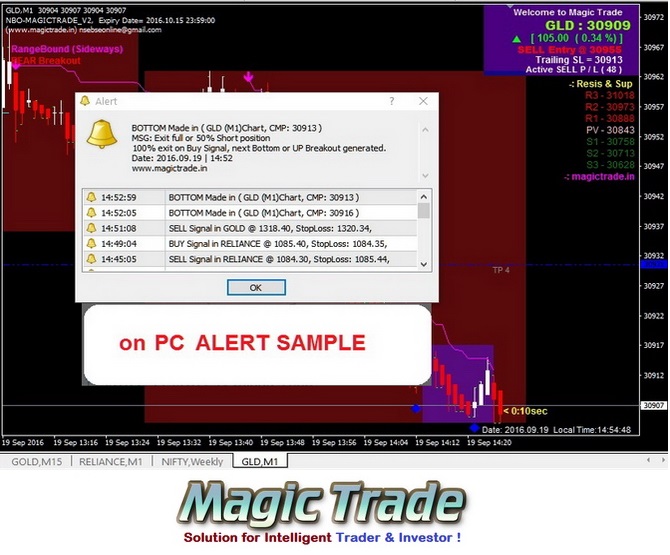

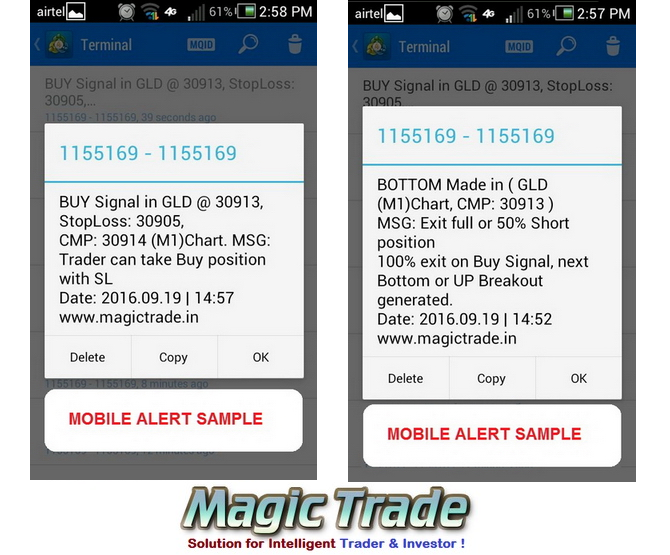

Popup Alert on PC & Mobile available.

This Function is available for METATRADER ( MT4 )

Trending Markets & Range-Bound Markets

Focus on our Magic Trade Range Bound System

Trending Markets

Trend indicators are most useful in trending markets and become much less useful in periods of price consolidation with low volatility. In technical analysis, a trending market can be defined as one in which market prices are making higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Trending indicators can help not only to determine the direction of a trending market but also the momentum of price movements and the most likely points of retracement -- the points at which a trend will temporarily turn in the opposite direction as traders take profit on their trend-based trades.

Range-Bound Markets

Ranging indicators are most useful in periods of price consolidation, or range-bound markets. Just like trending indicators, ranging indicators become much less useful in the opposite market condition. A range-bound market is one in which prices turn around at the same points repeatedly, creating clear areas of support and resistance and forming a clearly defined range. Range Bound indicators can help you define the strongest support and resistance zones within a range and determine when and in which direction the price is likely to break out of the range.

(FAQ) - Frequently asked questions for Intraday RangeBound

Q. What is a Range-Bound Market?

1. A range-bound market is one in which price bounces in between a specific high price & low

price. The high price acts as a major resistance level in which price can’t seem to break through.

2. Likewise, the low price acts as major support level in which price can’t seem to break as well.

Market movement could be classified as horizontal or sideways.